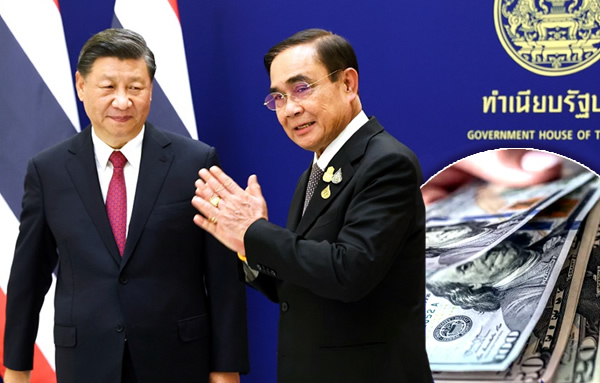

Sentiment regarding the economy has been rising since the return of Chinese tourists on January 9th last. However, with geopolitical tensions and indeed a trade war between the United States and China, now working with countries such as Russia and Saudi Arabia, as well as elevated energy costs, a dangerous ongoing war in Ukraine and rising interest rates, this choppy world economy presents Thailand with many challenges which must be navigated and tackled in real-time.

China’s economy, despite registering record-low growth in 2022 and being currently in the grips of its largest virus wave, is expected to rebound in the second quarter of 2023. It cannot come too quickly for Thailand which has suddenly, just in recent months, been left struggling against declining exports and competitiveness driven by a falling US dollar and a dearth of high-spending western tourists this year with the country’s foreign tourism high season coming to an end in March. Now, the kingdom’s economic fortunes in 2023 are seen as more closely bound to China than ever in a world where geopolitics continues to impact the economy in real-time, especially for an outward-looking economy like Thailand’s.

Thailand’s economy faces a testing time in the opening two quarters of 2023 with an anticipated slowdown in world economic growth and export demand continuing to fall into the near future following three months of higher-than-expected declines in shipments out of the kingdom with a 7.5% fall in output for December 2022 compared to the year before.

However, many economic forecasters are beginning to latch onto the news from China with projections of a promising recovery from the second quarter of 2023 due to the faster-than-expected reopening of the communist country and its economy to the world.

This comes as there are strong indications and reports that the huge virus wave that has impacted China in recent weeks may be receding despite a confirmed death toll of 60,000, a figure that many western analysts believe to be closer to 1 million fatalities.

Benefits seen already in China’s resurrection not only in sentiment, tourism but also cross border trade

The sudden collapse in China’s strict zero Covid policy and sharp turnaround by authorities is being seen positively by economic analysts in Bangkok as heralding a return of the Chinese economy to stronger growth in 2023 and the full reopening of its borders which is already positively impacting not only Thailand’s foreign tourism industry and sentiment towards the kingdom’s economic prospects but also cross border trade, especially in fruit and agriculture products.

Kasikorn Research Centre this week revised its economic growth prediction for Thailand from 3.2% to 3.7% based largely on more Chinese tourists and higher export demand from China from the second half of 2023.

This was echoed by Mr Sanan Angubolkul the Chairman of the Thai Chamber of Commerce who believes that the Chinese economy will rebound faster than anticipated at a rate of over 5% from the second quarter of the year.

Chamber of Commerce boss Sanan Angubolkul extremely concerned about currency volatility and the sharp appreciation of the baht against the US dollar

Mr Sanan, however, expressed his concerns over the extreme volatility seen in the Thai baht against foreign currencies particularly the US dollar after it gained over 13% against the greenback since mid-October 2022.

Baht gained against the dollar by over 13% since October 2022, good for inflation but bad for exports

‘Our greatest concern is the frenetic volatility of the foreign exchange rate, especially for the baht, which is strengthening more than other regional currencies,’ explained Mr Sanan. ‘Thai entrepreneurs have to prudently plan and manage foreign exchange risks to curb the impact on their businesses and trade.’

There is general optimism, based on a recovery in China, that Thai exports will recover in the latter half of 2023.

This week, the Joint Standing Committee on Commerce, Industry and Banking (JSCCIB) predicted that despite sharp declines seen in recent months, over the course of 2023, exports will grow by 1 to 2%.

JP Morgan among top banks spreading the good news about China to clients and investors in recent weeks

JP Morgan was strongly upbeat about a Chinese rebound this week when it told its clients that it believes that COVID-19 outbreaks in the country will peak in January 2023 and that a full economic recovery will settle in from the second quarter.

‘Even though Covid-19 infections in China rose rapidly after the country was reopened faster than expected, we expect the impact to be transitory,’ a briefing read.

In December, analysts in the United States also were predicting such a course as the US dollar continued its steep decline.

‘The China reopening is underappreciated. It would lead to a significant shift in economic activity,’ said Scott Opsal of the Leuthold Group while Philip Orlando, the Chief Market Strategist at Federated Hermes, predicted a similar rebound for China to what was seen in the United States in 2020.

‘In the second quarter of 2020, US GDP fell 29% quarter over quarter. In the third quarter, GDP grew 33%. It was the greatest economic boom in history,’ he said.

Tourism industry boss says Chinese tourists due to visit Thailand in 2023 are likely to be big spenders

The president of the Association of Thai Travel Agents, this week, was exceptionally bullish about Chinese foreign tourists visiting Thailand in 2023.

Mr Sisadiwat Cheewaratanaporn highlighted the confidence that Chinese tourists have in Thailand in the light of consistent surveys and searches showing Thailand as the country’s preferred holiday destination.

He pointed out that the tourists who have been arriving in Thailand since last week are likely to be younger, more affluent and high-spending independent travellers who are likely to spend more than those seen in the course of 2022 when Thailand relied strongly on other Asian markets such as India.

The kingdom’s traditional western basis for tourism has responded to the country’s foreign tourism reopening quite poorly.

This is thought to be a result of higher airfares to Thailand and also a loss of goodwill towards the country over its strict and unpredictable entry policies up to late last year which has led regular visitors to Thailand to opt for other holiday destinations.

Thailand is the preferred holiday destination for Chinese tourists who are looking to satisfy pent-up desires to relax and have a good time after Covid

Mr Sisadiwat said the latest arrivals from China have a pent-up demand to fulfil as they have endured three years of being unable to holiday and travel abroad.

The tourism boss underlined the importance of Thailand taking special care to cater for these high-quality visitors by offering the right services at the right price.

Mr Sisadiwat was confident that any short-term slowdown in the Chinese economy because of the virus would not deter these visitors.

He was also confident that travel tours will recommence from China in the second quarter of 2023.

He noted that Chinese advance parties were already visiting Thailand’s tourist hot spots and facilities to prepare such tour packages and that final approval from Chinese authorities was expected in due course.

Finally, he predicted that the Chinese market for Thailand’s tourism sector will take off when Chinese officials finally rescind the RT-PCR Covid test requirement still required for returning passengers to the mainland.

Falling dollar makes Thai exports and tourism less competitive in the United States and other markets

Meanwhile, the slowdown in the rest of the world and a sharp decline in the value of the US dollar will help to make both Thailand’s exports and its appeal to US foreign tourists and other western visitors less attractive at this time and into 2023 if the trend continues.

There are many reasons for the sharp decline of the US dollar including a weaker US economy despite its resilient jobs market but one key concern is efforts that are understood to be underway by other countries notably Russia, China and in particular Saudi Arabia to challenge and undermine the position of the US dollar as the world’s reserve currency.

This also brings us to warnings from a growing number of business leaders and economic analysts that the rising danger of geopolitical conflict and tensions is an ongoing threat to the world economy at this time which cannot be ignored even in the shorter term since the outbreak of hostilities in Ukraine last year.

Geopolitical tussle between the USA and China

The movement of US manufacturing away from China, the growing concerns over China’s activities surrounding Taiwan and a chip technology war are among a growing list of concerns pointing to a more divided and polarised world developing before us which have real-time effects on the value of country’s currencies and vital supply chains including food, energy supplies and international tourism.

The impact on Thailand’s tourism sector of higher energy costs in Europe, in particular, was addressed this week by Tourism Authority of Thailand (TAT) Director-general Yuthasak Supasorn who said Thailand must refocus its efforts to generate visitors on parts of the world less impacted by the current downturn.

In the United States, still Thailand’s largest export market, the US Federal Reserve is expected to again raise interest rates in January by a more modest 25 basis points or 0.25% but analysts fear that the central bank will insist on carrying on its all-out war against inflation last recorded at 6.5% until it is brought firmly under control.

US Federal Reserve’s battle against inflation will continue in 2023 but the impact is less predictable

That includes the country’s core inflation rate which in December came in at 5.7%.

That would see interest rates in the United States hover at around 5% for an extended period into the second or third quarter of 2023 leading America into a possible recession in 2023 or at least marginal growth with a current projection of just 0.5% growth for 2023.

The United States has, for some years now, bought more and more Thai goods and it has yet to be seen how the sharply higher valued baht will impact this.

Analysts fear that a weaker dollar may also perversely feed into further inflation with heightened commodity prices in the United States and its key markets, particularly for food which would be a nightmare scenario for the Federal Reserve, the United States and the world.

The possibility of this, driven by a sharp fall in the dollar, has arisen due to recession fears in the United States and the sudden emergence of the Chinese economy with growth prospects in the year ahead.

China’s economic rebound after the zero Covid policy disaster may have a sting in the tail for Thailand

This rebound in China, however, may have a sting in the tail for Thailand which has, for the last two years now, begun to benefit from industry moving activity offshore from the Chinese mainland including indirect export growth through manufacturing offshored to the kingdom.

The ongoing zero Covid policy in China was a disaster for its economy which is now being rectified.

Kriengkrai Thiennukul, the Chairman of the Federation of Thai Industries (FTI), has warned that Thailand may suddenly be facing more active competition from firms on the Chinese mainland.

‘After reopening, China will return to competing with other countries,’ said Mr Kriengkrai. ‘Exporting countries, including Thailand, will face a risk because we believe China will increase manufacturing for exports to make up for losses from when the country was closed.’

Thailand’s manufacturers also impacted by higher energy costs which are fast becoming a political issue

This is coming at a time when Thai manufacturers and business leaders are canvassing the government to reverse a 20% hike in electricity charges to Thai firms to be billed in January in order to pay for higher energy costs.

Pheu Thai to knock back skyrocketing electricity costs hitting business with a 21% rise in 2023 already confirmed

‘Higher product prices are unavoidable, meaning less sales, especially as people are still affected by inflation,’ Mr Kriengkrai warned this week. ‘Manufacturers shifted to renewable energy and automated systems to cut costs, but energy bills remain a serious concern.’

Pheu Thai, the main opposition party seeking a landslide to form a new government after the anticipated May 7th General Election, in December 2022, set out as part of its policy platform, a promise to intervene and lower electricity costs both to business and consumers in its drive to boost economic growth to 5% per annum while pledging to borrow more and expand public debt as part of its recipe to grow the Thai economy.

Siam Commercial Bank sees protests in China late last year as a key factor in jolting the country out of its lethargy. Predicts lower bank reserve move also

Kampon Adireksombat, a Vice President at Siam Commercial Bank saw the unprecedented protests in China last year and a sharper-than-expected slowdown in economic activities before this as jolting the authorities of the world’s second-largest economy into action after an extended period of lethargy.

Mr Kampon believes that it is very unlikely that the Chinese economy will enter recession this year and also predicts a sharp rebound even in the face of the country’s chronic banking and property crisis which has impacted large urbanised swathes of the country.

China moves to censor top western banks as its economy tanks before Communist Party summit

Property market collapse in China and a Chinese economic recession is the key threat to Thailand

‘In our view, the reopening of the country this time is a result of both a sharp slowdown in the economy and the protests in the streets during November 2022,’ said Mr Kampon.

He predicted that China would cut the reserve required within its banking sector in the first quarter in response to recessionary forces while the recovery itself, he felt, would help address the country’s property crisis,

‘The reopening of the country will help support the gradual recovery of the real estate sector. These are important factors that should help the Chinese economy to recover.’

Krungthai sees a long way back for Thai Tourism

The research arm of Krungthai Bank, Krungthai Compass, predicted in recent days that Thailand will attract 22.5 million foreign tourists in 2023.

This will be roughly twice the 10.2 million it projects as the final figure for 2022 which is lower than the 11.5 million official data suggests.

The Krungthai projections include 4.8 million Chinese arrivals contributing to Thai GDP growth of 3.4% compared to 3.5% to 4% projected by government agencies.

Krungthai projects that it will be 2026 before the kingdom’s foreign tourism industry recovers to the level it saw in 2019 when Chinese visitors accounted for 11.1 million of the 39.8 million visitors seen that year.

Join the Thai News forum, follow Thai Examiner on Facebook here

Receive all our stories as they come out on Telegram here

Follow Thai Examiner here

Further reading:

Thai economy up against it in 2023 despite the hype and hoopla over Chinese tourists returning

War erupts over Pheu Thai’s ฿600 minimum wage plan with the economy as the key election issue

Even as the baht surges, Thailand faces economic recession in mid-2023 with lower earnings

Soaring baht as the Thai economic spirit rises with one of the world’s lowest levels of inflation

Finance Ministry unveils green bonds as it seeks ฿900 billion for investment over four years

Thailand feels the pinch of lower tourism earnings as second ex-minister queries economic data

Former minister questions export growth data as Bank of Thailand plans to rein in consumer loans

Warning to central bank to preserve Thai foreign exchange reserves for a brewing 2023 economic storm

Baht slide continues as Bank of Thailand sticks to its dovish and soft approach to interest rates

Choppy waters for the economy as central bank tries to cling to its benign interest rate policy

Central bank reassurances as ex-minister raises loan quality with China’s economy in trouble

Prolonged Ukraine war to see Thai inflation at 6.3%, a stalled economy and a possible downgrade

Fears for Thailand’s economy over Ukraine war with rising inflation rates and loss of confidence

Thailand should move more towards a circular economy as the country faces intractable hurdles

Economy climbing out ‘of a hole’, foreign firm’s confidence levels rose sharply during October

Economic fears rising as Thailand faces a bigger crisis than 1997 with rising job losses and debt

IMF urges government to loosen nation’s purse strings as finances tighten with the tax take down